Consumer

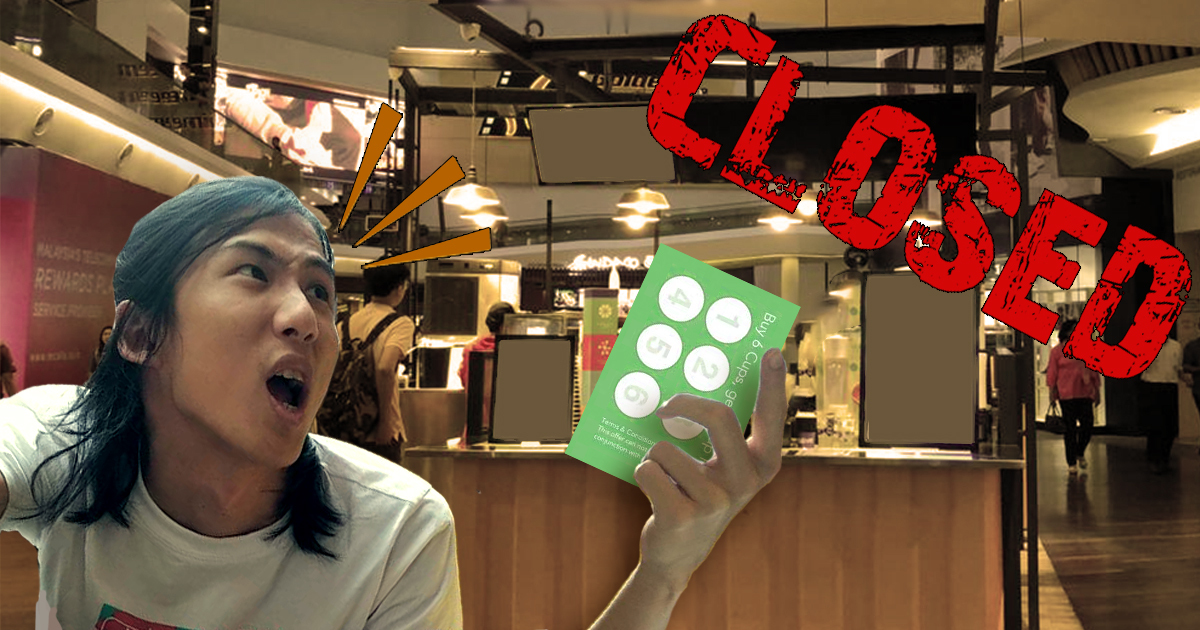

What happens to your reward points when a company shuts down in Malaysia?

about 7 years ago JS LimLook inside your wallet and you’ll probably find some stamp cards from your favourite food and beverage outlets. Even if you don’t like keeping any of those, you’re still probably a user of reloadable cards like the Touch ‘n Go service, and maybe Starbucks as well.

It’s sometimes difficult to imagine big, well known brands failing, but no company is too big to fail. Some of you are probably old enough to remember the time when people claimed the Lehman Brothers “couldn’t fail” - but look where they are now... Or to take a recent scenario, look at how TeaLive might be forced to cease all operations because of a dispute with Chatime.

So what happens if say, a company closes down, and you have a point card from their loyalty program? Does it mean that all your stamps and points are now worthless? What happens to the RM200 balance on your reloadable card?

In other words…

Can you still get your money back?

Broadly speaking, as a customer, you might transact with a company in one or more of these ways:

-

You pay, and you get your item

-

You collect stamps or points, which you can use to redeem rewards

-

You pay to get credits with that company, which you can use later (eg. reloadable cards and e-money)

-

You pay a deposit as security, which will be refunded later - like if you’ll be borrowing the company’s property (eg. bike sharing services and portable wifi services)

You wouldn’t have a dispute for number 1 because even if the company disappears, you’ve already gotten what you paid for. But can you still get your money back in the other scenarios?

We’ll break them up into 3 categories below.

1. Reward stamps and points

Can you get it back? – No

Most businesses adopt a loyalty program to encourage first time customers to return and, like the name says, to reward loyal ones. Like their product? Even better since you get some extra value now and then. As a frequent customer, those rewards are as good as cash to you - but could you exchange your stamps and points for cash if the company closed down?

No.

There’s not much you can do other than try to redeem them before the company actually closes down. You’d be correct to say that these promotions were promised to you by the company, but the promotions are also just add-ons which you didn’t pay for, which means it’s not mandatory for them to give you the rewards.

Legally speaking, the reward system of the stamps and points might not form a binding contract either. As per Section 26 of the Contracts Act 1950, contracts need to have what the law calls “consideration” - which is basically a promise to do something in return for the other person doing something as well. Think of it as there must be an exchange of A for B. Because you’re being given a reward system for nothing in return, no contract is formed and the company has no obligation to make good on it.

If you look on the reverse side of these cards, there is also usually a term stating that the company has the right to revoke or change the promotion as they see fit, without informing you. It typically reads something like this:

“The management reserves the right to alter, revise, or revoke any part of this promotion to its discretion, without prior notice.”

The outcome of that is pretty clear - they can choose to cancel the promotion at any time, and you can’t really stop them.

2. Reload credit

Can you get it back? – Yes

On the other hand, the story goes a lot differently with reloadable cards where you top up credit on the card to use later (like Touch ‘n Go), because you’ve actually paid money in exchange for those credits. So in this case, there IS a valid contract and the company actually owes you money if they shut down.

This comes from the area of contract law called “frustration”, which happens when a contract becomes impossible to carry out (nothing to do with the feeling you get when your favourite team loses). It’s given force in Malaysia through Section 57(2) of the Contracts Act:

You can read more about how the frustration of contracts work in our dedicated article about it. Basically, a contract becomes frustrated when what is supposed to be done becomes impossible or unlawful to do, which in turn makes it void (no longer takes effect).

[READ MORE - How does a contract get frustrated?]

The best example for this situation is where, let’s say you have an e-payment card from a coffee chain called Setarbuccs. After a few years in business, Setarbuccs closes down - but you still have RM100 pre-loaded on their card. It’s now impossible for you to spend your card balance, so your contract with Setarbuccs is frustrated (like you).

As for the consequences of the contract becoming void, we look to Section 66 of the Contracts Act:

This means that since Setarbuccs got money from you for the card balance, they’ll need to refund it if they close down.

3. Security Deposits

Can you get it back? – Yes

Talking about deposits can be quite confusing, mainly because we make deposits for many different reasons. There’s the deposit that works like a booking fee, called an “earnest deposit”, and then there’s the security deposit, which is an amount paid as security just in case you run away, or fail to pay up. You’re probably most familiar with security deposits being used in tenancy agreements when you rent a room or apartment.

[READ MORE - Renting in Malaysia? Here are 5 common legal problems you can easily avoid]

Now that we’re talking about security deposits specifically, you probably use a service or two where you need to pay a security deposit. These are usually for services where you need to use something that belongs to the company - like oBike’s bicycles, and the wifi devices you can rent for overseas use.

Consider this: if a company that collected a security deposit from you closes down, do they need to return your deposit?

The answer is a pretty obvious “yes”, but what if the company can’t pay it back for some reason? Turns out, that company may have just committed a breach of trust.

A “trust” is a legal construct where basically you pass your property to someone else, with instructions to use it for a specific purpose. A prime example of this is in wills - a trust is formed by the deceased, giving someone the power to distribute their property to their descendents.

[READ MORE - How do trusts work in Malaysia?]

A security deposit works along those lines, usually alongside a contract. The contract will state certain conditions when your deposit can be forfeited, like if you don’t pay the utility bills, or making sure you return their wifi device. Specifically, the company is holding onto the money to make sure you fulfill your contractual obligations. Unless you forfeit your deposit, THE MONEY STILL BELONGS TO YOU, so the company must keep the deposit in a separate account, and cannot use that money.

To sum it up:

-

If you did not forfeit your security deposit, it must be returned to you when your contract ends.

-

The company is not allowed to touch the money because it doesn’t belong to them.

What if they won’t or can’t pay me back?

It’s never good news when you hear that the credits you’ve paid REAL money for are now worthless - especially if they went bankrupt. We suggest consulting a lawyer if you need to reclaim big sums, but for anything below RM5,000, you might have an easier way through filing a small claim in the Magistrate Court.

[READ MORE - Here's how you file a small claim proceeding in Malaysia]

If you have a reloadable card with a bankrupt company, you might not be first in line to collect that debt from them. But in case of security deposits, you might actually get first dibs - because that money never belonged to the company in the first place, so they had no right to use it at all. Each situation is unique and even one small detail in the contract can matter, so it’s best to consult a lawyer if you need to better understand the situation and your options.

Jie Sheng knows a little bit about a lot, and a lot about a little bit. He swings between making bad puns and looking overly serious at screens. People call him "ginseng" because he's healthy and bitter, not because they can't say his name properly.