Civil

If someone borrows money and doesn't pay you back, Malaysian law can help

over 7 years ago Denise C.We have all been there – friends approaching us for a small loan during times of need. It may range from a quick, “Eh. Can spot me two bucks ah?” to the “I am really down on my luck recently, can you loan me some money for my house loan?”

Whatever it may be, some of us would have coughed up that dough because, friends. It’s not like you won’t get that money back because you have known your friend for so long. However, what if you loaned your friend say, RM4,500 and he promises fervently that he would repay you the money in two months’ time and...it has been a year but you haven’t seen a single cent.

As a matter of fact, you haven’t heard from your friend in awhile and you have been dropping him tons of calls and messages but it all goes unanswered. You are starting to get a little annoyed and that annoyance is added on when you see him jetting off to European countries for holidays. You think about bringing him to court but hiring a lawyer would cost even more than the money you loaned.

Before you cry over the lost money, you can actually go to court without a lawyer for this. Bear in mind that this article is for small loans (family/friends or even goods sold and services rendered below a certain amount) but not for big loans like bank loans. This procedure is called...

A small claims procedure

This procedure is found in Order 93 of the Rules of Court 2012 (be warned that the link to the Rules immediately downloads a PDF file).

The first question is how small is a small claims? A small claims is basically anything less than RM5,000. This means that in our example above, you would be able to rely on this small claims procedure to get the courts to help you make your friend cough up.

Order 93, Rule 2 Rules of Court 2012

“This Order shall apply to claims where the amount in dispute or the value of the subject matter of the claim does not exceed five thousand ringgit.”

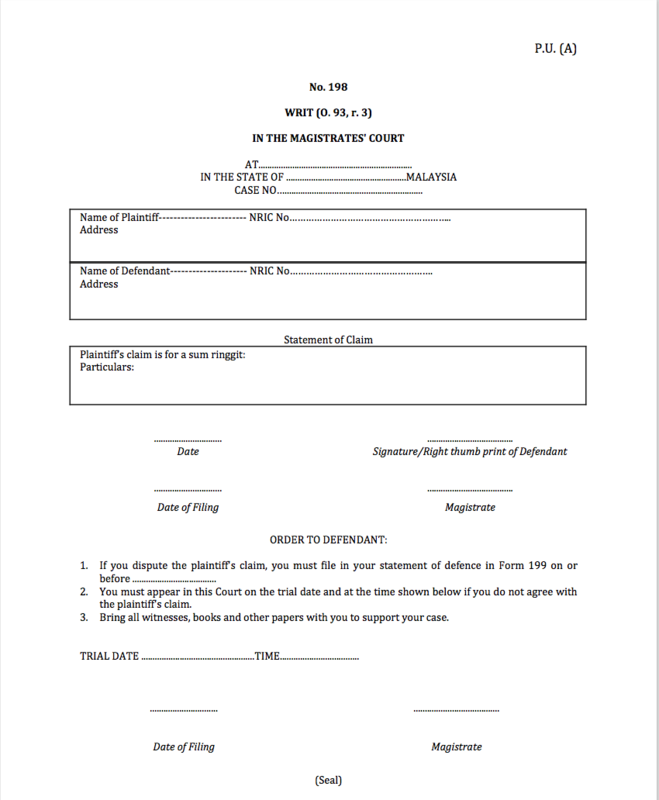

Starting this procedure is as simple as filling up a form (no, really). All you have to do is head over to your local Magistrates Court and fill in Form 198.

Image from tenor.com

What do you have to do when filling up this form? Bear in mind the next few points for when you need to claim some money back:

- Fill in your (Plaintiff) full name, IC number, and current address

- Fill in the full name, IC number, and last known address of you the person you lent money to (Defendant)

- State the exact amount you are claiming for

- State the particulars of your claim e.g when the incident happened, how it happened/why you are claiming in court. Bear in mind the golden rule of “less is more” for this part because generally the Magistrates wouldn’t want to wade through grandfather stories. If you have any evidence to show that you passed your friend money (bank in slips, text messages), hang on to those

- Sign the form with a flourish and hand over 4 copies to the Registry of the Second Class Magistrates together with a payment of RM10

After you hand over 4 copies to the Registrar, he will affix the Court’s seal on all copies of your form and then set a hearing date for you. Don’t worry about making photocopies because one copy will be returned to you.

After receiving that copy, you would have to send it to the person who borrowed money from you. You can either do this personally or by registered post only. Do not be a skint and use normal post to save a couple cents because you actually need to prove that you have sent the form over and this is found in Order 93, Rule 5(2):

“The service of Form 198 may be effected by personal service or by prepaid registered post addressed to the last known address of the defendant.”

An important point to note is that while you may consult a lawyer for filling up the form and taking you around the courts, you are not allowed to be represented by a lawyer during the hearing. Basically, you will represent yourself. This rule is found in Order 93, Rule 7.

Now that you have sent off the form, all you have to do is sit back and relax. However, don’t be surprised to learn that...

The person you loaned money to can fight your claim

Before you froth at your mouth and scream about ungrateful people, take a deep breath and know that this is part of the idea of justice – that everyone has a right to defend himself in court.

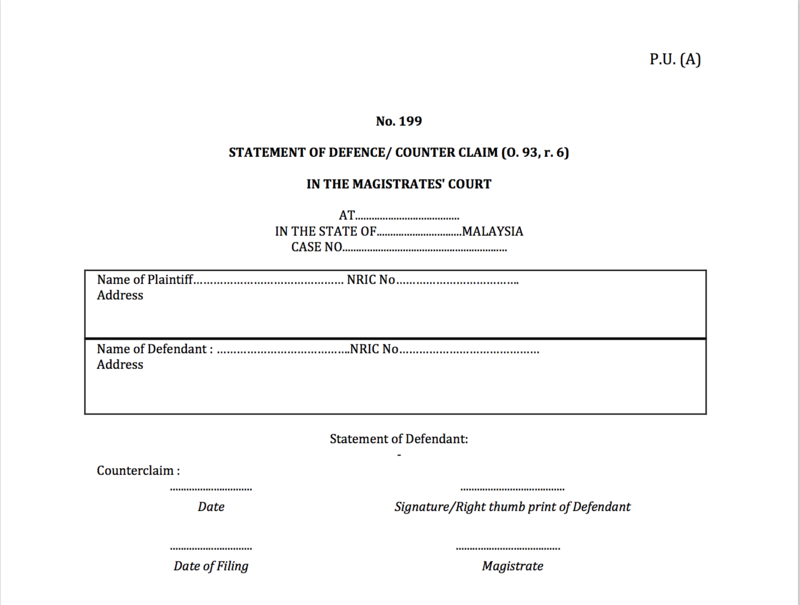

So what happens after you send that form off by registered post is that the borrower has 14 days from the day he receives the form to file a defence. He can do this by filling in Form 199 with the Registry in 4 copies. Basically this form will state down the following:

- If the borrower (defendant) admits that he owes you money, he will fill in the reasons why he admits to it

- If the borrower denies that he owes you money, he must similarly fill in the reasons why there is no money owed

- The borrower can also initiate a counterclaim against you. A counterclaim is where the borrower claims money from you instead. You can similarly file a defence against this counterclaim through Form 200

For the sake of completion of knowledge, when the borrower files this form with the Registry, he will either pay RM4 (for a defence) or RM24 for a counterclaim.

Now, you might be wondering what will happen if your borrower doesn’t file a defence (or fails to do it within 14 days) or doesn’t show up in court. We will address this in the next section because regardless of what he does, you will still end up in the same place.

You must make sure to attend court at the set date

If either of you fail to attend court, then the court can dismiss the action or make an order that he thinks fit (Order 35, Rule 1). This means that if both of you don’t show up in court, the judge can just throw your case out.

If only you are absent from court, then the judge can rule in favour of the borrower and can order you to pay the borrower for his counterclaim (if any) and even for any costs that he has incurred from defending himself from your claim. This is found in Order 93, Rule 8 and done through Form 203.

On the other hand, there are two ways for you to get a decision in your favour. The first is where the borrower doesn’t show up in court, the court can use Form 202 to order him to pay up what he owes you plus the costs you incurred for bringing this claim. The court will also dismiss his counterclaim (if any).

The second is where the borrower doesn’t file his defence to your claim. The court may either rule in your favour using Form 201 or he may postpone the hearing to another date in order to allow your borrower to file his own defence.

However, an important point to note here is that if you get a decision in your favour just because the borrower didn’t show up in court/didn’t file his defence, the borrower can later own ask the court to “set aside” that decision. This means that he can apply for the court to throw out that decision and ask the court to come to a new decision. This is found in Order 10, Rule 1. You can also apply for a setting aside judgment if you were absent from court and you must do this within 21 days of the judgment being served (sent out) on you by the court.

However, assuming both of you show up in court and your borrower files his defence, then the court will examine the facts and listen to both sides before coming to a decision. If he decides that your friend does owe you money, he will make a judgment/order for him to return you the money. The next question you might have is this, having a court order is all well and good but what if he still doesn’t pay up?

Find out in Losertown

The court can make him pay up

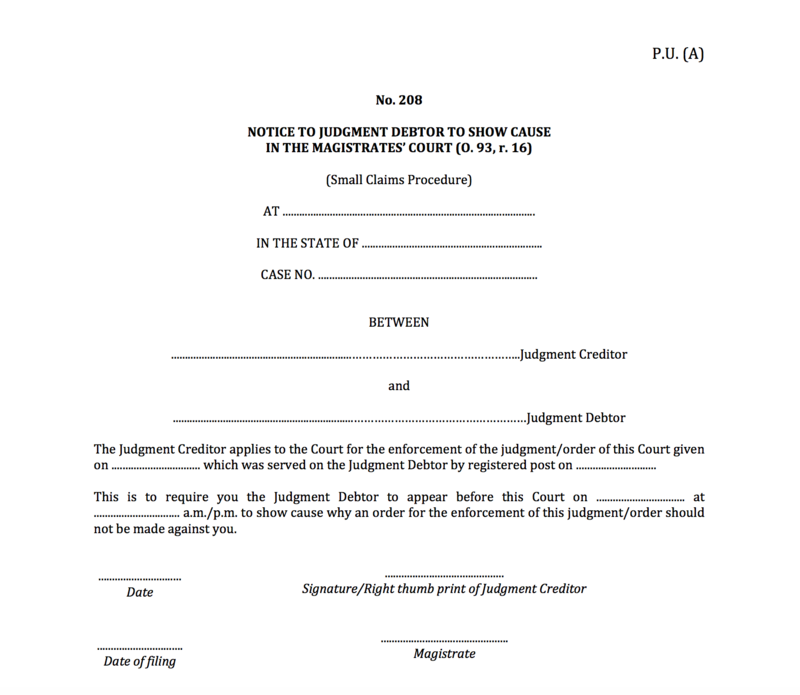

What happens when the court makes an order is that they will serve it on the person through registered post. The borrower then has to comply with this judgment/order. If he fails to do so, you can make an application to the court through Form 208 (known as a notice of show cause) and after the court endorses it, you can serve it on your borrower using the same methods mentioned above (either personally or by registered post).

Basically Form 208 will state that the following points for the borrower to note:

- He must deposit the amount the court ordered him to pay you with the court within 10 days

- If he doesn’t do so within 10 days, he must appear in court at the given date

- If he doesn’t appear in court, the court will issue a warrant for his arrest

[READ MORE: What is the difference between a warrant and a summons in Malaysia?]

If the borrower shows up in court, then the judge will make one of the following three decisions:

- He may allow the borrower more time to pay you back or set up an instalment plan

- He may order a writ of seizure and sale. This is basically the judge ordering court bailiffs to go to the borrower’s house to seize his belongings for auction in order to pay you back

- He can sentence your borrower to jail

Now that you know how to file a claim, defend yourself in court, and how to enforce a judgment, go forth and claim all the monies that you are owed. However, since the procedure is pretty long and troublesome, it might be good to remember the age old adage of, “only lend money if you are comfortable with never getting it back”.

Aside from that, if you are a borrower reading this article, we know that you may have fallen on hard times but sometimes, just communicating with your friend/family goes a long way in making them feel like you are not taking them for granted.

"No no I clean"