Consumer

Can Malaysian shops make you spend a minimum amount to use credit cards?

over 6 years ago Denise C.Image credits to National Pharmacy at 163 Mont Kiara, who most definitely don’t impose a minimum purchase amount.

There are many alternatives to cash these days. First, we have the traditional credit cards. Then, we have the e-wallets, the QR payment methods and the list goes on and on with technology developing faster than ever.

Given how there are so many cash alternatives, you forgot to withdraw money for your date but didn’t bother doing it because that’s what cash alternatives are for. The date goes swimmingly well and dinner turns into desserts. When you finally call for the bill, you just whip out your credit card only to have the waiter go,

“Sorry sir. Credit cards are only for RM100 and above.”

You bluster, not wanting to lose face in front of your date but the waiter stands firm. Minimum spending amounts are necessary before they accept your credit card. As you fret about it, your date pulls the bill over and pays it. You’re embarrassed. What’s the point of pushing forward cash alternatives if they are going to make you spend more? Actually...

They can’t impose a minimum transaction amount

You may be surprised to learn this because minimum transaction amounts are so common in Malaysia that no one bats an eye at it. As a matter of fact, Malaysians are so used to it that we rarely quibble about it with the retail store owners, usually just pulling out some cash or resorting to our friends to help chip in.

However, some digging around revealed that the credit card companies such as Visa and Mastercard actually have rules that are meant for the merchants to adhere to. They are known as scheme rules and all retailers would have to comply with them.

For example, under the Visa Core Rules and Visa Product and Service Rules which was last updated on 13 October 2018 states the following:

“All participants in the Visa system are subject to and bound by the Visa Charter Documents and the Visa Rules, as applicable based on the nature of their participation and geography.”

Now that we know the retailers are bound by these rules, let’s skip down to Rule 1.5.5 where it says:

“A Merchant must not establish a minimum or maximum Transaction amount as a condition for honoring a Visa Card or Visa Electron Card.”

To break it down, what this rule means is that a retailer is not allowed to stop you from using your card even if you are only paying for RM1.

The same rules can be found in the Mastercard rules (this downloads a copy of the rules), last updated on 28 June 2018 which contains the same prohibition to retailers under Rule 5.11.3.

The rules don’t explicitly mention whether these rules apply similarly for debit cards but given how debit cards are also defined as Visa and Master products, it would be a fair assumption to make that retailers similarly can’t impose minimum amount transactions before you can use your debit cards.

Now that you know they are not allowed to do this, the next question is, what can you do when retailers still impose minimum amounts?

You can lodge a complaint to Bank Negara

Bank Negara has an app known as BNM MyLink (Google PlayStore and Apple Store) which allows consumers to lodge complaints through if they have dealt with any retailers who impose a minimum transaction amount. Bank Negara also provided a detailed instruction on how to lodge a complain here.

It’s important to note that you may need to get the following details from the retailers:

- Name

- Address

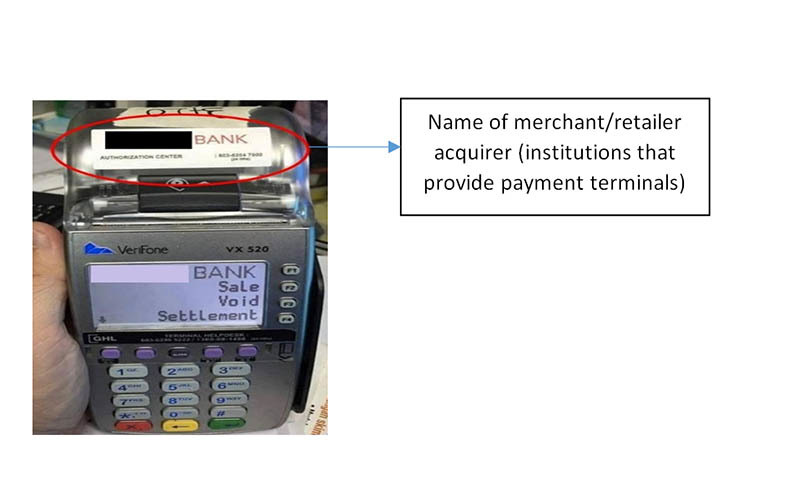

- Acquiring bank (which bank is servicing that shop)

Bank Negara can also be contacted through their Facebook page here. So now if you are ever caught in such a tussle, you would know what to do but do try not to take it out on the employees there because they are just enforcing company policy.

[READ MORE: Is it legal for Malaysian shops to charge you extra for paying by card?]

"No no I clean"