Consumer,General,Banking

Bank Negara's AKPK helps Malaysians manage their debts for free. Here's how it works

almost 6 years ago ArjunYou’re at that point in your life where your friends are a little jealous of you. You have a nice car, a big house, your own business, and awesome wife and kids. On the outside, you’re living the Malaysian dream.

But here’s the thing: while things look good on the surface, behind the scenes you’re struggling. You took up loans for that house, car and business – and you’re struggling to pay it off.

In such situations, things can spiral pretty far. And for someone struggling with debts, the worst thing that could happen to them is becoming bankrupt. Which basically means you’re broke under the eyes of the law.

[READ MORE: How do bankruptcy proceedings work in Malaysia?]

What happens if you can’t pay your debts?

According to a study done, Malaysians earning RM 2,001 to RM 4,000 spend up to 55% of their income to pay off loan debts. Generally the types of loans taken are education loans, housing, car, and personal loans (with either your car or house as security).

As mentioned earlier, the worst thing that could happen if you can’t pay your debts is that you become bankrupt. But before that happens, depending on the kind of debt you’re in, your creditors would first look to repossess the things you still owe payment for, such as your car or house.

Once they take over your house and car, they can still sue you for money, if there’s a difference between the amount you borrowed and the value of your car and house. The banks right to sue you for money could apply to unsecured personal loans (meaning no house or car as security), PTPTN and credit card debts. And if the bank wins the case in court and you still can’t make your payments, the bank could then start bankruptcy proceedings against you, making you a bankrupt.

But before things get to that stage, there are things you can do to prevent it. Bank Negara has set up an agency called AKPK (Agensi Pengurusan Kredit dan Kaunseling) to help people deal with their debts, and the first thing you should know is...

AKPK helps people settle their debts FOR FREE,

According to their AKPK’s website their main task is to...

They achieve this goal by providing two types of services:

- financial counselling

- debt management programme

Since we’re focused on getting out of debts, we’ll discuss the debt management programme. The first thing you should know is that, under the programme, AKPK will create a new payment plan for all the debts you have with your banks.

This programme usually starts with meeting up with an AKPK officer at their AKPK branch. During that meet up, the officer will calculate your financial commitments (basically how much you spend for everyday things and your loans). After that, the officer will proceed to come up with a new plan for your loans/debts.

To secure you a new plan, AKPK will negotiate with your banks to restructure your loans. According to their website, AKPK will try to convince your banks to group your loans, and come up with one new payment plan. AKPK will then act as a middleman of sorts between you and the bank. So instead of paying it straight to the banks for your many different loans, you’ll have an agreement with AKPK, where you make payments to them and they will dispense the monies to your creditors.

Do note that AKPK won’t reduce your debts in the process; you still owe what you owe. But what they’ll do is come up with a longer payment plan which could be easier for you to pay on a monthly basis.

In addition to that, AKPK will also help you come up with a budgeting plan – so you may have to spend a bit more wisely (which means you may have to switch your boba sessions to teh-tarik).

And to make sure you don’t incur any new debts, during the debt management process, you will have to cancel off your credit cards and to not take on any new credit facilities (like loans and credit cards).

And if you’re thinking this service is going to be hard to apply for….

You can apply for their debt management programme online

So if you’re looking to manage your debts, it’s not gonna be a hard process. You just have to go online and sign up for the programme. Afther that, you’ll be given a date to meet up with the AKPK officer and go through the process we mentioned earlier.

But it’s important to point out that not everyone will be eligible for AKPK’s programme. There are actually certain eligibility requirements for the programme:

- you must not be bankrupt

- you’re not getting sued

- you have sufficient net disposable income (meaning you got enough spending money after paying taxes)

- your debts are not more than RM 2 million

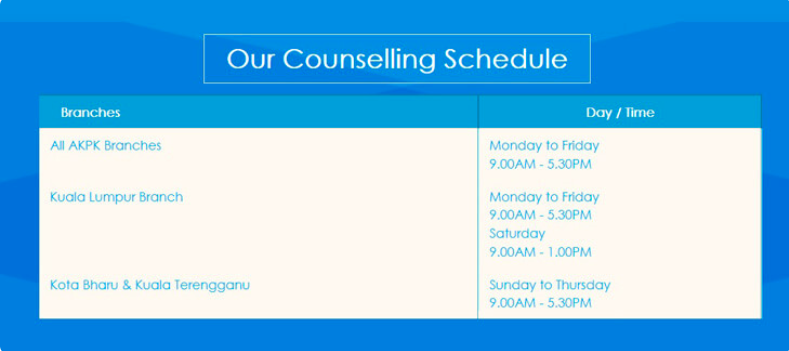

In addition to that, even if you are not in debt, you can still go to AKPK for financial counselling services. Basically this is where you go into AKPK for advice on budgeting and how to manage your money. You don’t need an appointment for this service, but AKPK has specific times for it:

I'm so woke I don't sleep