Corporate

If a company in Malaysia fails, can I sue the directors?

over 7 years ago Denise C.Have you ever wondered what directors in a company do? As kids, we would watch movies featuring old, white men sitting around an oblong table, shooting off their approval for decisions numbering in the millions and then they would waltz away to flirt with their secretaries and be chauffeured off in a nice gleaming Bentley. This is all good and fine if the company is doing well but what if the company is struggling to stay afloat and the director gets a new Rolls Royce?

So, if you are an investor or a shareholder with a company that goes belly up or if you realised that your company suffered incredible losses in the past year and you think that this is caused by the directors of the company mucking about, you might actually wonder if these directors can be sued.

Malaysia recently overhauled the laws that governs companies in Malaysia with the new Companies Act 2016 and you would be very pleased to learn that you can actually sue directors for breaching their director duties. By the way, this article is not aimed at investment schemes which is a wholeeee other ball park.

[READ MORE: If you lost money in a Malaysian pyramid scheme, can you get your money back?]

Before we move into the how you can sue part, let us give you a brief overview of what duties directors have (by the way, it doesn’t matter if they are the directors of a two dollar company or a multinational company, they still have director duties to fulfil).

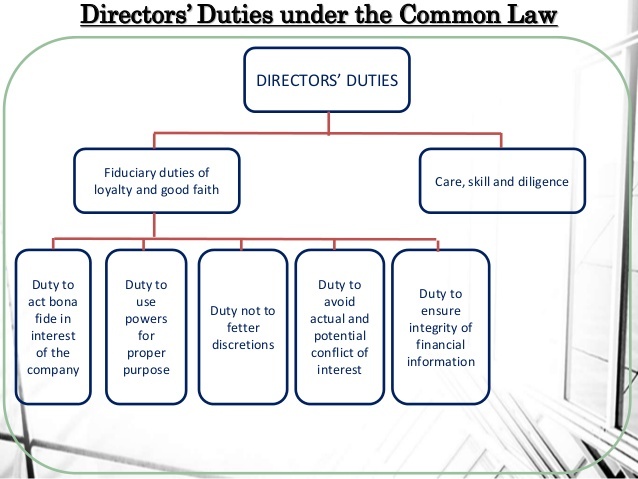

Directors actually have a whole list of duties under Malaysian law

The Companies Act 2016 (“CA 2016”) actually sets out a list of duties that directors of companies in Malaysia would have to adhere to. However, in order to keep this article succinct, we shall focus on three (more) common duties.

The first duty can be found in section 213(1) which sets out the duty for directors to act within the powers that have been given to him. To put it in context, there are two ways a director can gain his powers from in Malaysia. The first would be through the Companies Act 2016 and the other way would be through the company’s constitution (we will explain what this is later on in the article).

Section 213(1) Companies Act 2016:

For example, if the CA 2016 states that directors are allowed to allot company shares subject to them gaining approval through a company resolution first. This means that if a director were to allot shares without a resolution authorising it, they would be acting beyond their powers and could be guilty of a breach of director duties.

If you are clear on what the Act says and are scratching your head over the constitution part, because you thought that only countries have constitutions, don’t fret because an explanation is rightttt here.

The first thing you need to know is that a company’s constitution works, more or less, in the same way as a country’s constitution. It sets out the basic rules that the company has and as explained in section 33 of the CA 2016, the constitution also binds every member in the company. This means that not only is the constitution enforceable by the members against the directors, it is also enforceable between members of the company. Section 31(2) CA 2016 also explains to us how a constitution works hand in hand with the relevant Malaysian laws. In essence, if the CA 2016 allows some discretion for the companies to set their own rules, they can do so. It is important to note that under the new CA 2016, it is not mandatory for every company to have a constitution – it is optional.

Section 31(2) CA 2016:

Aside from not exceeding the limits of their powers, directors are also supposed to exercise their powers in a way that they were intended to be exercised. For example, if a director has the power to allot shares, he can allot them in a way that would benefit the company as opposed to allotting them in a way that would make themselves richer.

The second duty is found in section 213(2) and it states that:

This duty to exercise reasonable care, skill and diligence may sound rather vague but the courts would judge this using the objective and subjective tests.

The objective test is found in part (a) of section 213(2) wherein the judge would look at whether the director had acted in a way that other directors with the same skills and responsibilities would have acted. This means that the judge would look at how the general population of directors would have acted. For example, if you are a director and you made the decision to sell your company for RM10,000 while every other director out there would have sold it for a minimum of RM50,000, you would probably be guilty of failing to exercise reasonable care and skill.

However, section 213(2) also involves a subjective test. A subjective test is where instead of the judge looking at the knowledge and skill that the general population of directors would have, the judge would look specifically at any additional knowledge and skill that you have. This means that if you had any special knowledge that would give you greater skills than a “normal” director would, you would be judged with those standards in mind as well. For example, if you were a director of a company and you had a degree in accounting, the courts would look at that degree and would more likely than not find you guilty of failure to exercise reasonable care and skill when you decided to sell off your company for RM10,000.

The objective and subjective tests found in section 213(2) means that the judge is required to consider the objective knowledge of directors as well as the knowledge of the director in question.

This duty is meant to ensure that directors do not abuse their positions as directors in order to gain personal benefits. An example of a situation like this would be if the director of Company A influences his company to enter into a contract with Company B because he owns shares in Company B and would stand to gain a lotttt of money if the deal goes through.

The CA 2016 aims to prevent situations like these by requiring directors to declare any interests they may have in a proposed transaction. Section 221(1) says:

This means that it would potentially be a breach of a director’s duties if he were to sneakily try to steer the company into being part of a deal that benefits him and not the company. To our more observant readers, you might realise that this duty would potentially overlap with the first duty where the Act states that directors have to act “in the best interest of the company”.

Such an observation is accurate as the sections that govern directors’ duties can overlap and it essentially means that all those old-timey images we have of directors enjoying life and expensive lunches do not stand anymore. Directors are not allowed to take a hands-off approach in running the company. This is illustrated in the UK case of Lexi Holdings v Luqman where the court stated that directors must keep themselves informed of what is going on in the company and participate in management.

Now that you are aware that directors do have duties to fulfil to the company, the next question you have would be, how in the world do you sue directors?

There are specific rules and procedures to follow when sueing directors

As a general rule that was established in the very, very old English case of Foss v Harbottle (this was decided in 1843, when even our grandparents weren’t born yet), a company is the proper plaintiff. This means that the company is the only one who can bring a legal action.

But herein lies a catch with the rule in Foss v Harbottle, if the companies are the proper plaintiffs and if directors control the companies, how could you ever sue a director that has been messing up? The rule in Foss does allow for several exceptions but they were very hard to use.

This is where section 346 and section 347 of the Companies Act 2016 steps in and provides you with ways to sue your directors. There are actually several other ways you can sue a director (through a shareholders’ agreement, company’s constitution and a winding up petition) but this article will focus on what is contained in the Companies Act in order to avoid confusion.

This remedy is found in section 346 and it reads as follows:

You need to know what is going on in the company

At the end of the day, the law can provide directors with various duties and you, the shareholder, with various remedies. But if you just take a hands off approach in caring for the companies that you invest in, then no amount of law can help promote good accountability. Shareholder activism is an important part in keeping directors accountable and preventing them from acting beyond their powers.

So, on this note, invest wisely and remember to consult your lawyer if things go awry.

"No no I clean"