Corporate

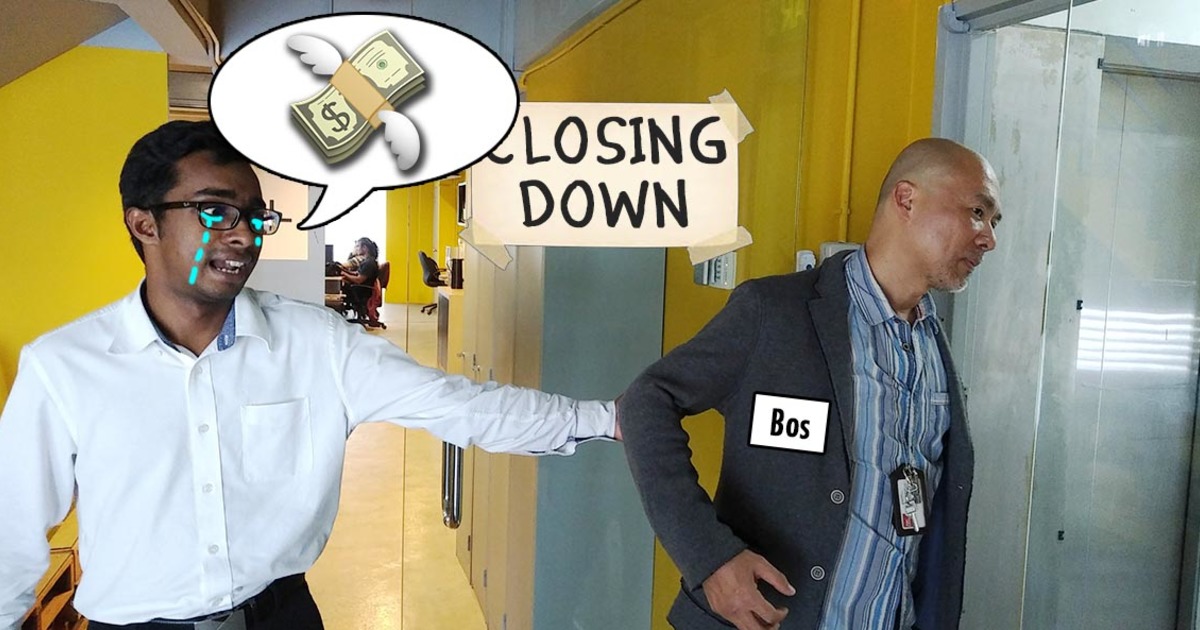

If a Malaysian company that owes you money goes bankrupt, can you sue the boss to get it?

about 7 years ago dineshsadhwani

This article was written by Dinesh Sadhwani, a practicing advocate and solicitor of the High Court of Malaya.

At some point in time, you may have heard of the term “corporate veil” or “piercing the corporate veil”. But what do these terms mean exactly?

For the purposes of this article, we’ll be looking at two very basic but important principles of company law (whether in Malaysia or many other jurisdictions) which translates to a company having the following features:

-

It is a separate legal entity – i.e. it is separate from its shareholders, directors and other representatives and capable of exercising all the functions of a body corporate and have the full capacity to undertake any business or activity including to sue and be sued, to acquire, own, hold, develop or dispose of any property and to enter into transactions. This is recognised by Malaysian law under sections 20 and 21 of the Companies Act 2016 (“Companies Act”).

-

The shareholders of the company are generally not responsible for the company’s debts and other obligations – Specifically in the case of shareholders, their liability or risk is only up to the amount they have invested or agreed to invest in the company. If the company were to go bust, the shareholders have no legal responsibility to rescue the company or inject further capital. This is known as the ‘limited liability principle’ and can also apply to directors, other representatives / agents and employees.

The corporate veil in this sense is the separation between the company and the people behind it, that, in a way they’re seen as separate entities.However, this represents the general rule. As with all rules, if this rule is applied strictly without exceptions, it can be abused.

Let us take the hypothetical example of an unscrupulous businessman, Mr Suka Tipu Orang (STO):

Mr Suka Tipu Orang incorporates a company, Fraud & Sham Sdn Bhd, to carry on business. Mr STO uses the company to purchase goods on credit from its suppliers. The company sells the goods to its customers for cash. Mr STO then siphons out all the cash from the company through various means. This leaves the company without any cash. Mr STO has no intention of having Fraud & Sham Sdn Bhd pay its suppliers and other creditors (landlord, employees, EPF, IRB, etc).

If we apply the general rule strictly, it’s the company – and not Mr STO – who is responsible for all transactions with its creditors (Point 1), as the transactions are carried out in the name of the company. Even if the company’s creditors sue the company and win in court, the creditors will end up with mere “paper” judgements as the company has no assets to settle those judgments. Not just that, the creditors cannot sue Mr STO personally (Point 2) to get their money. And so, if the general rules are strictly followed, Mr. STO will get away scot-free with his ill-gotten gains.

At the risk of stating the obvious, the separate legal entity and limited liability concepts are well intended. The intention is to facilitate business or entrepreneurial activity and encourage bona fide risk taking. However, due to the potential for abuse, the law has also created exceptions.

There are instances where the people behind the company can be held personally responsible for acts purportedly carried out by or in the name of the company. This is sometimes called “piercing the corporate veil”, which is to go behind the so-called “corporate veil” or “legal entity” and hold the ultimate “controlling mind” of the company personally liable.

So let’s take a look at some of these exceptions below.

Fraudulent trading

Let us consider the case of a company that has gone bust (i.e. its debts are more than its assets) and the creditors have no choice but to take a significant haircut – fancy business term for a discount – on the money owed to them. To thicken the plot, investigations reveal that the directors have mismanaged the company and even siphoned out monies for their own benefit. If we strictly adhere to the limited liability concept, the creditors can only sue the company and not the directors, even if they were dishonest in their business dealings.

Luckily, the creditors may have a remedy thanks to Section 540 of the Companies Act.

Section 540 of the Companies Act 2016 – Responsibility for fraudulent Trading (in part):

What this means in simple terms is that if someone has used the company for fraudulent purposes (such as we saw in the Mr STO example), that person can be held personally responsible for the company’s debts.

One of the most recent decisions on this area of the law in Malaysia is the case of Prem Krishna Sahgal v Muniandy Nadasan where, long story short, a managing director of a since closed-down company attempted to appeal against a fraudulent trading claim by his former employees. The Federal Court found that the company's funds had been siphoned out through various means, including to companies connected to the managing director, and ruled against him.

Using the company as a sham device

Although “fraud” and “sham” are used as interchangeable terms in everyday conversation, there’s a slight difference between the two. Essentially, a “sham” is the smoke-and-mirrors used to disguise something while a “fraud” is outright fakery or cheating. As an example, a sham would be putting a Mitsubihi emblem on your Proton Inspira to con people into thinking it’s a Lancer. A fraud would be selling that same car by advertising it as a Mitsubihi Lancer.

Unlike section 540 in the point above, this “sham” exception does not have statutory footing and is instead a creature of the courts. What this means is that this exception is not specified in the Companies Act or any other act passed by parliament. Rather, the courts have taken the initiative and recognized the need to prevent the use (or abuse) of a company to evade responsibilities or obligations based on previous cases.

The famous British cases of Gilford Motor Co Ltd v Horne and Jones v Lipman are best illustrations of this. British cases are used as reference in Malaysian courts, for reasons which you can read more about here:

[READ MORE: Where does Malaysia get its laws from?]

In the Gilford Motor case, Mr Horne was the former managing director of Gilford Motor. When he left the company, his employment contract prevented him from competing with Gilford Motor. To get around this restriction, he set up a company under his wife’s and an employee’s name to compete with Gilford Motor. Needless to say, Gilford Motor sued Mr Horne, and won. The court said:

In Jones v Lipman, Mr Lipman agreed to sell land to Mr Jones. Mr Lipman later changed his mind before completion of the sale and purchase agreement and transferred the land to a company where the sole directors and shareholders were him and his nominee. Mr Jones sued Mr Lipman and his company. The court held in favour of Mr Jones and said:

In some cases, evading responsibilities may not only just involve a simple case of not paying debts (such as the example of Mr STO) – it can be a situation where someone is taking advantage of the separate legal entity principle to do something which that they’re not legally supposed to do.

Other laws and (possibly) lawsuits

Other than the Companies Act, there are various other laws that specifically allow for the directors of the company to be personally liable for certain debts of the company. Two prominent and good examples of this are the Employees Provident Fund Act 1991 (“EPF Act”) and the Income Tax Act 1967 (“ITA”).

Other than the Companies Act, there are various other laws that specifically allow for the directors of the company to be personally liable for certain debts of the company. Two prominent and good examples of this are the Employees Provident Fund Act 1991 (“EPF Act”) and the Income Tax Act 1967 (“ITA”).

Section 46 of the EPF Act makes the directors of the company jointly and severally liable for the company’s unpaid EPF contributions. Similarly, section 75A of the ITA provides that where any tax is due and payable under the ITA by a company, any person who is a director of that company during the period in which that tax is liable to be paid, shall be jointly and severally liable for such tax that is due and payable. “Director” in section 75A has a special definition i.e. someone who is occupying the position of director (by whatever name called and includes any person who is concerned in the management of the company's business) and either directly or indirectly has control of not less than 20% of the ordinary share capital of the company.

The rationale behind this is that the separate legal entity / limited liability concept should not be used as a shield to evade liability towards employees and the tax authority.

One interesting issue is whether a director can be held personally liable for tortious acts (e.g. negligence or defamation) committed in the course of acting as director on behalf of the company. A tort is essentially a legal right to sue someone for a wrong-doing, even though the parties may not have any contractual relationship between them.

[READ MORE: What’s a tort? Can eat wan ah?]

This discussion itself would require a separate article but, in a nutshell, the general position is that a director should not attract personal liability in tort (cannot be sued) for simply carrying out his role in governing the company. It may be different if the director has abused his position and gone beyond his proper duties. For example, if a director makes a genuine press statement on behalf of the company and the statement contains defamatory material, the director should not be personally liable for defamation. However, if the director has a personal vendetta or axe to grind with someone and uses his position as a director to issue a defamatory statement (purportedly on behalf of the company) for personal motives, the director could be personally sued.

When there’s a veil, there’s a way

The core of company law (in this context, the separate legal entity / limited liability principles) is driven by commercial considerations in the sense that genuine businessmen need an avenue or entity to carry out legitimate business ventures without the fear of being personally responsible should the venture fail – which can happen for various inadvertent reasons (e.g. bad luck, recession, competition, wrong business model, etc).

At the same time, the law recognizes that there will be unscrupulous parties who will abuse this avenue and cause hardship to other third parties (as we say in the example and various cases discussed above) – hence the exceptions to the general rule. The challenge is, of course, in ensuring that the law does not cause genuine businessmen to feel deterred in embarking on a venture because of the fear that one might fall within the exceptions if things go sour.

In any case, for those who think that doing business under a company is equivalent to having an unconditional license or right to whimsically use (or abuse) the company – especially to carry out unlawful activity or to intentionally evade debts / commitments – and then turn around to say “Sorry, it was not me but the company. You cannot sue me but please go ahead and sue the company.” – you are strongly advised to think again very carefully!