If your insurance agent in M'sia can't get 10/10 on this quiz, you may need a new one

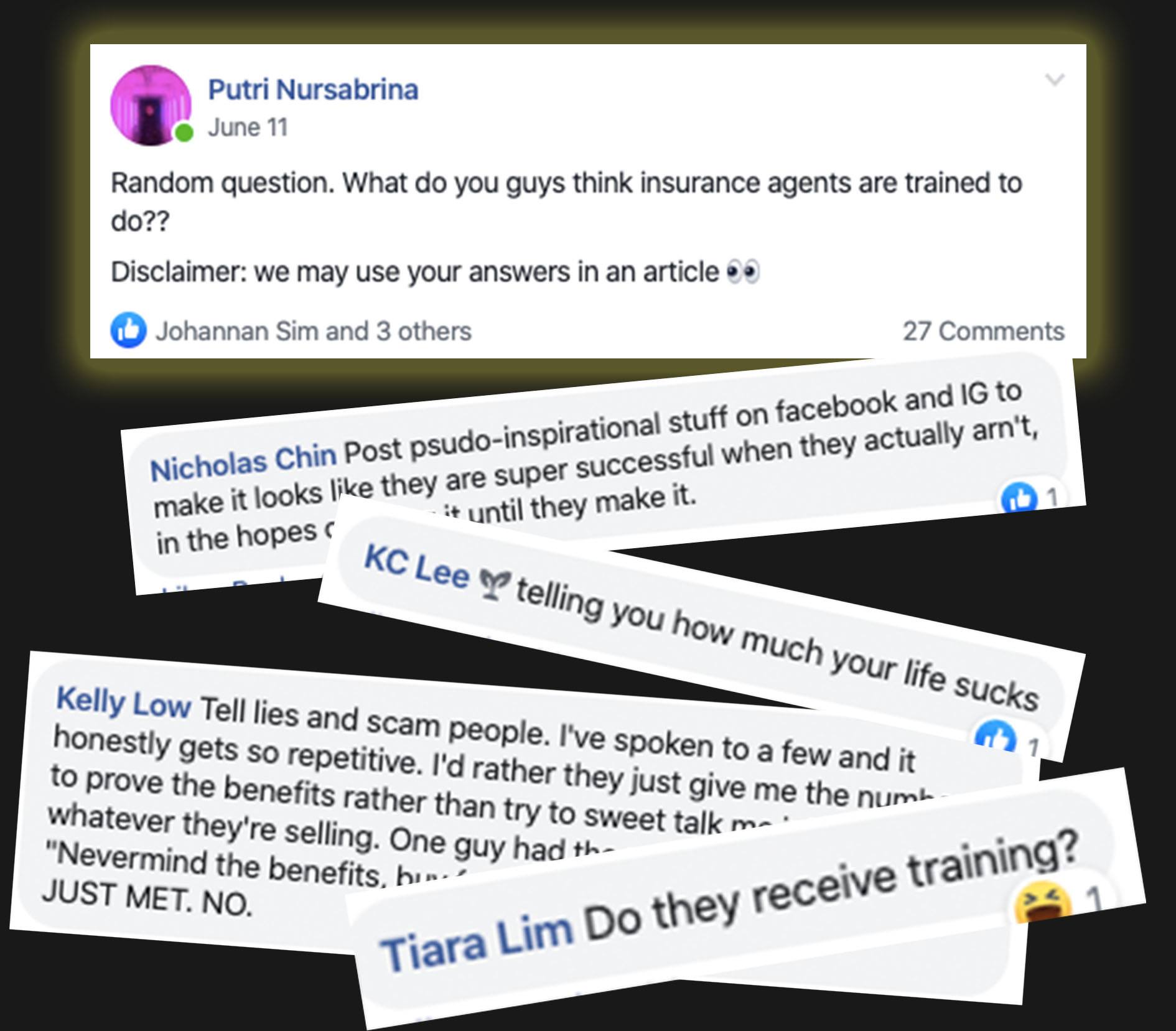

over 5 years ago Sponsored ContentWhat comes to your mind when we say the words “insurance agent”? A writer from our sibling site Cilisos asked this in their Facebook group once, and here’s some of the… uh… nicer comments:

Well, to be fair, there is some truth in these because we have some pretty annoying insurance friends to begin with *cough*Hi Marcus*cough*

At the same time other stereotypes of insurance agents – like how your parents used to tell you that you’ll be an insurance agent if you don’t study – are outdated at best. Our friends at AIA have been actively trying to switch people’s perceptions about this particular stereotype. AIA gave us the chance to meet with a couple of trainer superstars, so we took the chance to find out just what kinda training they had to go through.

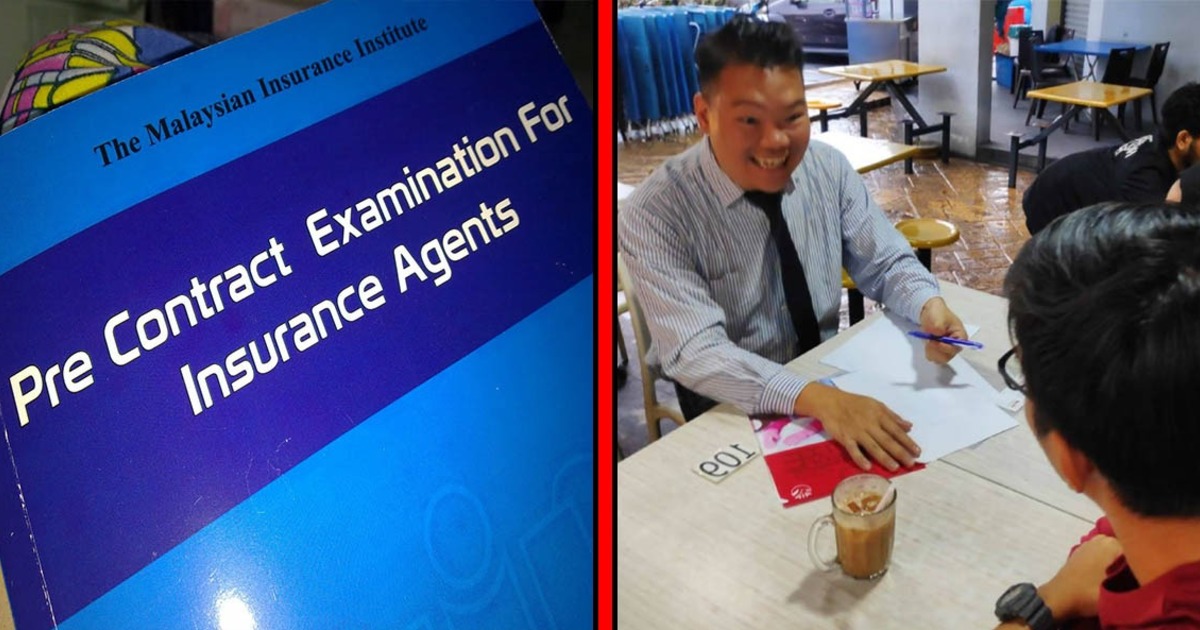

For one, we learned that insurance agents actually have to sit through a bunch of exams to be certified. Not just that…

… the passing rate for insurance-related exams is as low as 60%!

What kinda exams, you ask?

“CEILI, TBE, PCEIA*… these are just some of the industry requirements,” Azlin Kamarulzaman, an AIA Agency Leader tells us. “If you really want to be a life planner, then THAT is the first hurdle you need to overcome.”

*Certificate Examination In Investment-Linked Life Insurance, Takaful Basic Examination, Pre-Contract Examination for Insurance Agents

And, no… the only way you can pass these exams is through hard work and sweat

“No under-table money, the conditions are very strict,” Franco Wong, an AIA Agency Trainer replied after we asked if there’s any chance of buying your way in. We were also told that anyone can take the insurance exams but, if you’re not smart or studious enough, you can pretty much forget about passing.

OH. We should note that AIA doesn’t call their agents as ‘insurance agents’ - they’re called ‘Life Planners’, for reasons we’ll reveal at the end of the article.

Coming back to exams, our trainers also tell us that you also have to be updated in areas such as medicine, finance, investment and law. “You need to know your stuff,” Azlin says. And we can imagine that too - as insurance agents help plan our lives, it would be irresponsible if they had no grasp on these things.

So, seeing as we were in the presence of insurance experts (aaaand AskLegal may or may not have gotten their hands on the PCEIA sample exam questions by the Malaysian Insurance Institute), we wanted to challenge our readers to see how well they can score in our mini insurance agent quiz! These are general insurance questions and not specific to any insurance company or policy.

Franco and Azlin helped with answering and providing explanations for these questions, so you can have a go at it to see how you compare to an insurance agent. Better yet, if someone approaches you to sign up for an insurance plan, test their abilities with this quiz!

There’s actually so much more to insurance training than you think

Actually, there’s a reason why we chose to write this article - and that’s because our friends at AIA are well aware of the negative perceptions towards a career as an insurance agent. Or, well, in AIA’s case, a Life Planner. They don’t want people to see their agents as pushy salespeople with no proper training or background - they want them to be seen as who they should be: intelligent, industry-certified Life Planners who actually add real value to the lives of the people they approach.

But it takes a lot to change this mindset, so that’s why they have the AIA Elite Academy - a place where budding agents can receive all the training they need to be successful Life Planners themselves. (And, who knows, reach the ranks of Azlin and Franco)

Thankfully, it’s not all professional exams and hard-core studying. “Soft skills are critical,” Azlin tells us. He adds that in his company, he has set up several training modules such as the ‘ABC’ training course, which focuses on the agents’ Attitudes, Business mindset, and Career mindset.

“Malaysia really needs awareness about the concept of insurance,” Franco adds. To him, insurance just doesn’t seem like a priority in personal budgeting. “Retirement seems so far away to many 20-sometings. They’d rather spend RM5k on a phone instead of protecting themselves.”

And perhaps with a realignment of what insurance agents are really trained to work, would help the public see insurance beyond its salesy facade. To find out more about the AIA Elite Academy, click here.